admissions

tuition & financial aid

our goal

Riverview’s focus remains on educating neurodivergent students through a curriculum that supports them completely. Because of this, we are proud to work with you to make our program more financially accessible so you can focus on what matters most – your child.

It’s a Great Time to Apply

We are accepting applications for Middle School/High School and GROW 2026 Summer and 2026/2027 School Year programs.

by the numbers

Families that are fully or partially funded by their district or school

The cost of speech/language assistance, weekend activities & trips, and other additional services

Financial aid awarded by Riverview each year

Facts, Figures, and more

Explore the details below and review these helpful guides on out-of-district placement and funding provided by the Massachusetts Association of Approved Private Schools.

School Year Middle/High School (Day) – 2025/2026

Tuition: $65,831

Deposit: $7,000

School Year Middle/High School & GROW (Residential) – 2025/2026

Tuition: $113,491

Deposit: $10,000

Summer Middle/High School (Day) – 2025

Tuition: $7,019

Deposit: $2,500

Summer Middle/High School & GROW (Residential) – 2025

Tuition: $11,505

Deposit: $3,000

The Riverview School offers financial assistance to families who otherwise would not be able to afford the cost of a Riverview education.

Financial aid is an outright grant, used to offset the cost of tuition, which your family does not need to pay back to the School. Applications are reviewed by our Financial Aid Committee, comprised of trusted members and chaired by the Director of Finance. We strive to accommodate as many families as possible within the financial aid budget; all financial aid at Riverview is based on demonstrated financial need.

*Only students who have been accepted or are re-enrolling to Riverview can receive Financial Aid.

The Tax Cuts and Jobs Act of 2017 contains a provision that allows use of Section 529 savings to pay for private K–12 education up to $10,000 per year, per child starting in 2018. Establishing and funding a Section 529 plan can provide significant tax benefits. See your investment advisor and accountant for more information.

As you may or may not be aware, the Internal Revenue Code provides that expenses paid for medical care are deductible to the extent such expenses exceed 7.5% of adjusted gross income. Tuition paid to a school qualifying as a “special school” under the U.S. Treasury Regulations is considered a medical care expense. Generally, a qualifying special school is one that employs special methods and resources for alleviating a mental or physical handicap. The curriculum of a special school may include some ordinary education, but this must be incidental to the primary purpose of the school to enable the student to compensate for or overcome a handicap. For more information, click the button below to read the full letter regarding the deductibility of tuition.

Any questions regarding tuition or financial aid, please contact Stewart Miller at smiller@riverviewschool.org or 508-888-0489 ext 203.

apply for financial aid

Step 1:

Please fill out the Parent Financial Statement at School and Student Services.

Step 2:

Download and complete the Financial Aid Application.

Step 3:

Email the completed application to financialaid@riverviewschool.org.

Resources

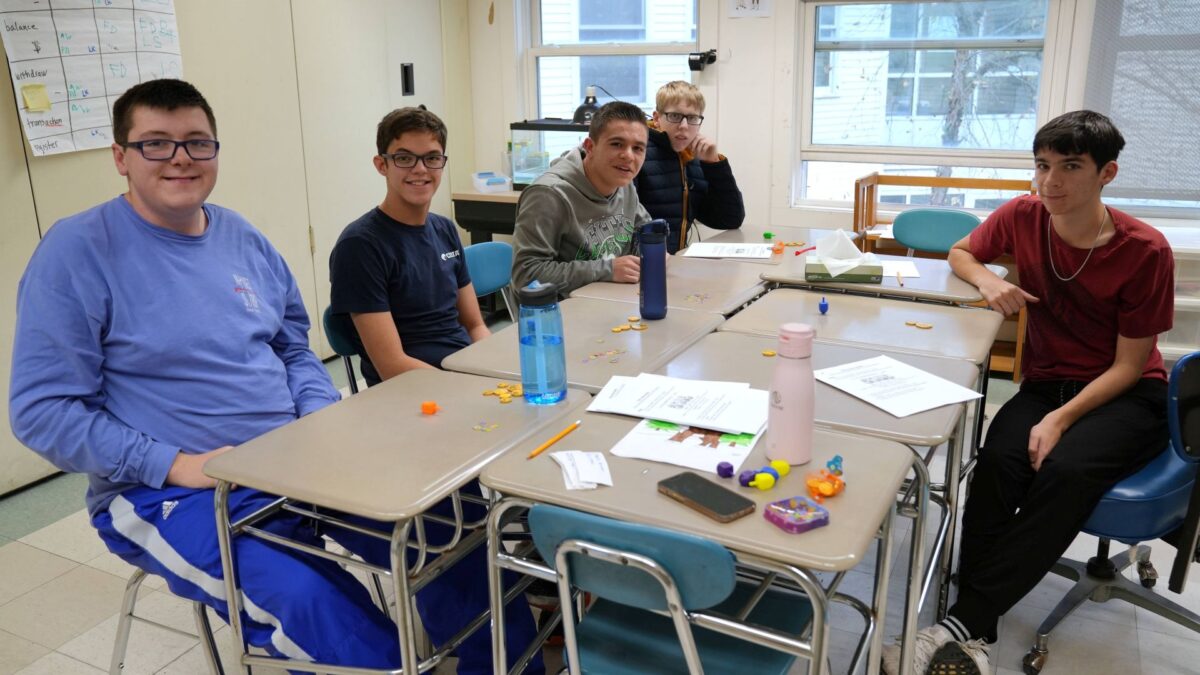

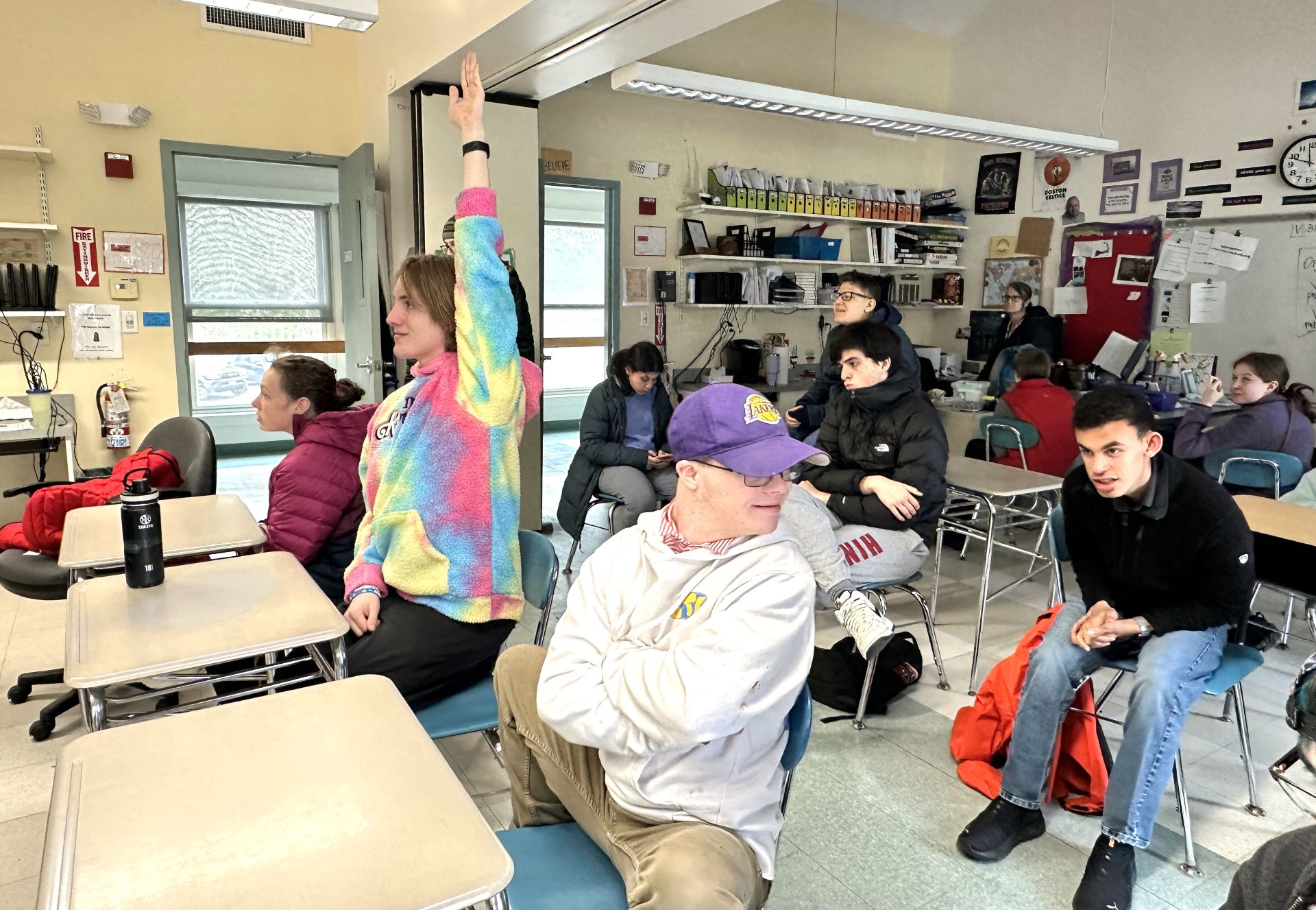

See for yourself

Check out our Guided Tour of Riverview with Director of Admissions, Lauren Spencer, explore a virtual map of our campus, and be sure to join us for an in-person information session.

We’re Here to Help

Riverview School is dedicated to supporting students, parents, and families. Please reach out to our Admissions Office with questions about the admissions process, whether Riverview is right for your student, or any other inquiries you may have.

Greg Angland

Head of Admissions & Marketing

Lauren Spencer

Director of Admissions

Anthony Beer

Admissions Associate

Nanci Pacheco

Admissions Office Manager